Despite the Federal Reserve raising interest rates once again and all the political cross-currents, it turned out to be a good quarter for the stock market and a slightly positive one for bonds. Your portfolio participated broadly on the upside to mark another positive quarterly return and you did so with considerably less risk. We have often used the metaphor that the stock market is like a rocket journey. When the rally took off in November, the space ship (stock market) had a full fuel tank that could support a long trip. The subsequent rally has used up much of the fuel, as momentum carried stocks higher. We used this market rally to take some profits and trim back stock positions in your portfolio and are evaluating new investment opportunities.

Is a Major Market Decline Ahead?

Over the quarter, several of you expressed concern that the market moved up too far, too fast, and questioned if there is too much market optimism or even euphoria. Could this type of atmosphere lead to another major market decline like the 2000 Tech Bubble Bust or 2008 Financial Crisis? We believe the short answer is NO!

“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.”

The nature of some of your concerns tells us we are likely somewhere in Templeton’s sequence between skepticism and optimism, but not yet euphoria. While we recognize growing investor optimism and the relatively high stock valuation levels, a major decline is not likely imminent because we see no immediate recession threat.

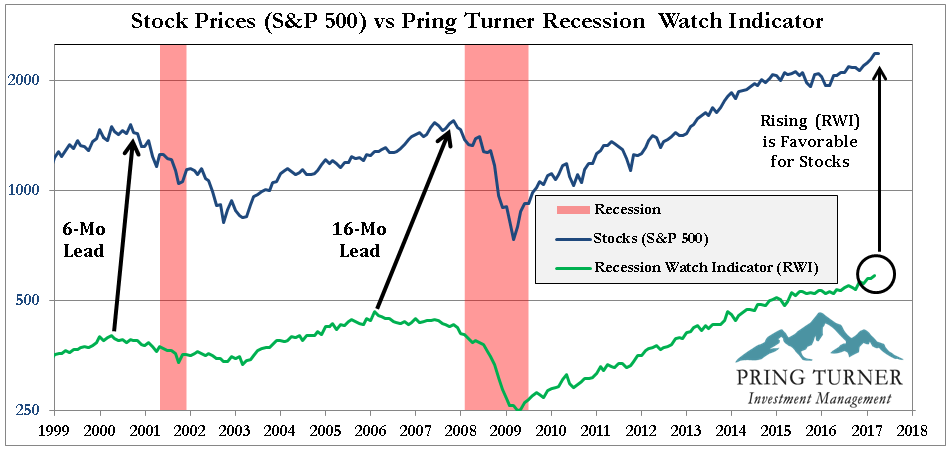

Recessions or economic contractions in the business cycle are the most likely culprits in bringing on severe stock market declines. This is why we pay very close attention to economic trends. Today’s analysis of our Recession Watch Indicator (shown on page 2) shows continued business cycle growth: a favorable stock market environment. However, smaller market declines each year are normal and to be expected even in strong bull markets. Actually, we welcome the temporary cooling-off period to replant your portfolio with fresh profitable investments. In other words, this modest pullback is really an opportunity for us to add stocks at better prices laying the foundation for your future profits. Our longer term models, like the Stock Speedometer that we featured in several of our recent newsletters, are still signaling safe investing conditions. So as the fuel tank refills, you can expect us to add what we believe are quality, bargain priced and income-producing investments to your portfolio.

Source: Pring Research, Reuters

New Highs for the Recession Watch Indicator Suggests Low Risk of Recession Today

Recession Watch Indicator

Most severe stock market declines (-20% or more) have occurred during economic recessions. For retirees it is especially critical to avoid recession driven market declines in order to effectively secure a stable retirement lifestyle. Recovering from these big losses can be a difficult and highly stressful endeavor. That is one very important reason why we closely follow the natural rhythm of business cycle swings and stay on alert for the next major turning point in the economy. The Recession Watch Indicator (RWI) featured above is a leading indicator for the economy designed to signal the onset of recession months in advance. What is this reliable forecast tool telling us now? The latest reading has pushed this leading economic indicator to new highs, signaling continued business expansion and that there is low risk of recession in the months directly ahead. Continued economic strength should translate into higher stock prices.

Searching the World for Opportunity

Adding to the quote from Sir John Templeton earlier, we’d like to share another timely observation courtesy of this astute investor. Fresh out of college, Templeton began his career in the midst of the Great Depression and in time became one of the world’s most legendary value investors. In the mid-1960’s he was one of the first money managers to invest in Japan—a true pioneer in international investing. At the time, Japan was a rather obscure and small stock market but it was one where he found great value. What might Sir John think of today’s global markets? We sense he would once again appreciate the ample opportunities in overseas stock markets, especially compared to the relatively expensive valuations in the U.S. While the U.S. has been outperforming the rest of the world for most of the last 8 years, history teaches us to always be on alert for leadership reversals. After many years of lagging behind, international values have become more compelling with less downside risk and more upside potential. Also, dividend yields are more attractive with higher income. In addition, investor pessimism has been building for years on international markets, which is contrarily a good signal for long-term value investors.

The combination of these elements leads us to believe that investors in international markets will be nicely rewarded in the years ahead. These factors help explain why we have gradually added international themes to your stock portfolio. With an entire world of opportunity to choose from, we will continue to seek out better returns with less risk wherever presented.

Sir John Templeton

A Great Role Model

Money magazine (January, 1999) called Sir John Templeton “arguably the greatest global stock picker of the century”. On top of our deep admiration for Sir John Templeton’s investment prowess, we are more impressed with his philanthropic activities. He was one of the most generous philanthropists in history, giving away well over $1 billion to charitable causes. Templeton established the £1,000,000 Templeton Prize in 1972. The annual Prize is intended to recognize exemplary achievement in advancements related to life’s spiritual dimension. Its monetary value exceeds that of the Nobel Prizes. The Templeton Prize grew out of his belief that an honor equivalent to a Nobel Prize should be bestowed on living innovators in spiritual action and thought. Mother Teresa of Calcutta was the first Templeton Prize Laureate. Indeed, Sir John’s life serves as a Pring Turner role model not only for his investment skills but for shining the light on all of the noble causes that accumulated wealth can nourish.

Active Risk-Management to Protect Wealth

Even though our outlook is still positive today, history teaches it will not always be that way. When financial conditions eventually deteriorate, rest assured we will take steps to protect your wealth. We have long adhered to an “active” investment strategy. “Active” is best defined as meaning active risk-management. An active risk-managed approach emphasizes both a game plan for offense in good periods and, most importantly, one for defense during cyclical bear markets. For example, when economic and financial market conditions deteriorate, we will take action to protect your portfolio. In simple terms, bond and cash exposure will be increased while stocks are reduced. Investment adjustments will be made gradually and methodically (we are the antithesis of high frequency traders). As the economic evidence changes, we will make portfolio changes with one overriding goal: to protect your valuable assets through the inevitable downturns. Our long term performance history shows that one thing we have done very well over the decades is to protect during down periods. If we do a good job protecting in downturns, it is much easier and less stressful to achieve higher levels of wealth in the next good period.

Conclusion

For now, we believe the major trend for stocks is still up. There is no recession on the horizon that would alter our optimistic view for the economy and stock market, as evidenced by our Recession Watch Indicator. Does that mean we can just sit back and relax? Absolutely not! Much of our time is spent preparing a well-thought-out game plan to actively shift to a capital protection mode before the next storm clouds begin to appear. Our continuous focus is identifying the next major turning point for the economy and markets.

Rest assured, we take your concerns and financial security very seriously. Our dual mandate is to “protect and grow” your wealth through both cyclic ups and downs. We have spent our entire careers studying market and business cycles to develop active risk management tactics that grow your wealth steadily and carefully. Over a full bear and bull market cycle and certainly over the last 40 years, we have done just that—attempt to protect and grow your valuable assets! Thank you for your trust and confidence. Please let us know if you should have any questions or if your circumstances should change.

Pamela Ross

Operations Manager

Our Very Own Pamela Ross Invited to Address the United Nations!

Pamela is proud to be a part of an international coalition of human rights leaders whose ongoing efforts successfully defend and protect those most vulnerable. She has been dedicated to raising global awareness about the critical issues of sexual exploitation and human trafficking since becoming literarily aware of them at 12 years old. Recognized for her leadership, knowledge and dedication, Pamela was recently invited to give a presentation at the United Nations in New York City on global strategies to reduce violence against women and girls. She has had the privilege to address these issues at conferences at Columbia University, the French Consulate and now the United Nations. On top of Pamela’s busy life managing the office and running trails, she feels blessed to serve and uplift others.

Pamela at the United Nations, March 2017

We are honored to support Pamela in her passion to raise awareness about human rights issues and empower others to better their lives. Well done Pamela!

New All-Time Highs Once Again… What’s Next?

Click Here to Download the PDF

DISCLOSURES:

Pring Turner Capital Group (“Investment Advisor”) is an investment advisor based in Walnut Creek, CA. The Investment Advisor invests on behalf of individuals, organizations, and other financial advisors that appreciate a conservative and active investment style that aims to deliver consistent results without taking undue risk. The key objective of the Advisor’s investment philosophy is to not lose big during major market declines, making it easier to compound wealth over the long run.

The Investment Advisor is registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Investment Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments.

In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Investment Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. Past performance is no guarantee of future results. ©2017 Pring Turner Capital Group Walnut Creek, CA. All rights reserved.