Since the market peak in late July, stocks suffered a sharp decline of roughly 8%. Recession worries, labor strikes, government shutdown talk, rising energy costs and higher interest rates are all taking a toll on investor emotions. Fear has begun to replace greed and we believe that sets up a good window of opportunity in select high-quality stocks. In our July newsletter, we alerted to the potential for stock prices to take a breather: “Although a short-term correction is possible, we will continue to actively seek opportunities to add attractive investments to your portfolio.” Indeed, you may have noticed some recent transactions as your portfolio becomes more fully invested. Our view is that the stock market consolidation this summer will turn out to be “a pause that refreshes” and sets the stage for a strong finish to the year.

Bad News, Good News

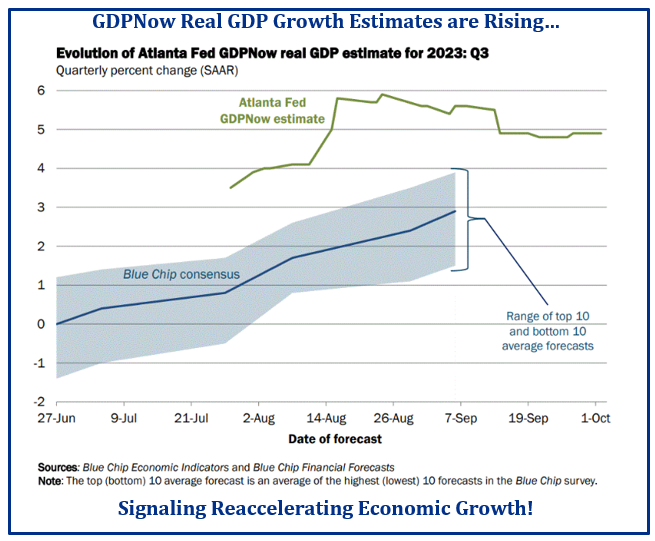

The bad news is that interest rates have gone much higher than anyone would have expected. The good news is that rates are moving higher because the economy is showing far more resilience than forecasted. Case in point: the latest GDPNow forecast by the Federal Reserve Bank of Atlanta estimates a nearly 5.0% annualized growth rate for the 3rd quarter. While we doubt the quarter will actually finish that strong, the latest estimates argue against an imminent recession. Alternatively, an extended economic recovery is more likely.

Higher than expected economic growth should lead to higher-than-expected corporate earnings. In turn, higher profits will support further stock market upside potential.

Reasons to Stay Optimistic

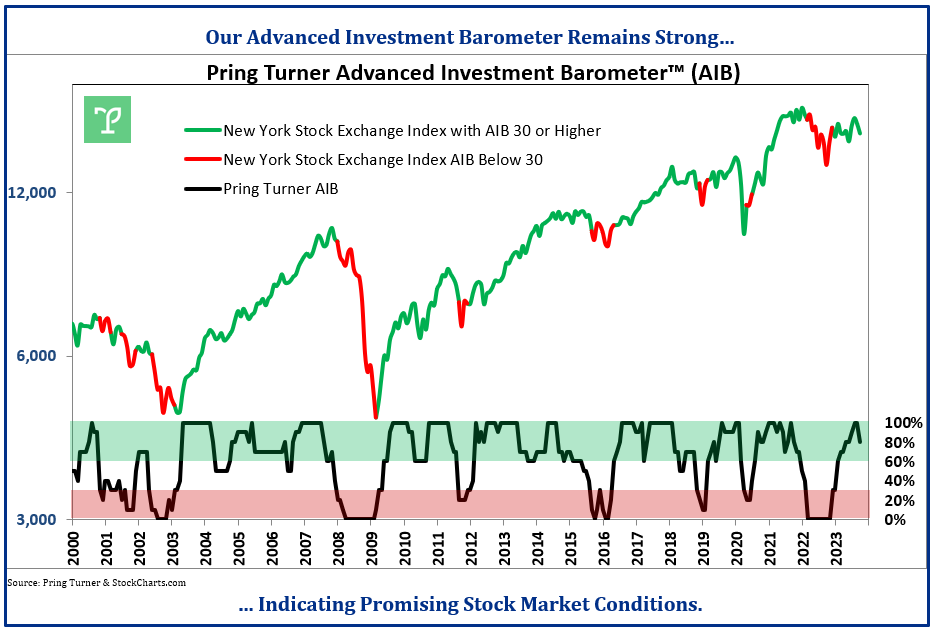

Our January newsletter featured our primary trend stock market indicator, the Pring Turner Advanced Investment Barometer (AIB), which had begun shifting to a more favorable position. This model helps us decide, on a longer-term timeframe (1-year plus), if we should be focused on growing or protecting portfolios. Despite the summer swoon in stock prices, the AIB is still flashing a green light for a continuing cyclical bull market. That signal gives us confidence that the long-term trend for stocks is still up.

Historically higher readings have led to better returns for the average stock; conversely, lower readings have led to poorer returns. It makes sense to stay optimistic when the AIB model is in the “green zone”.

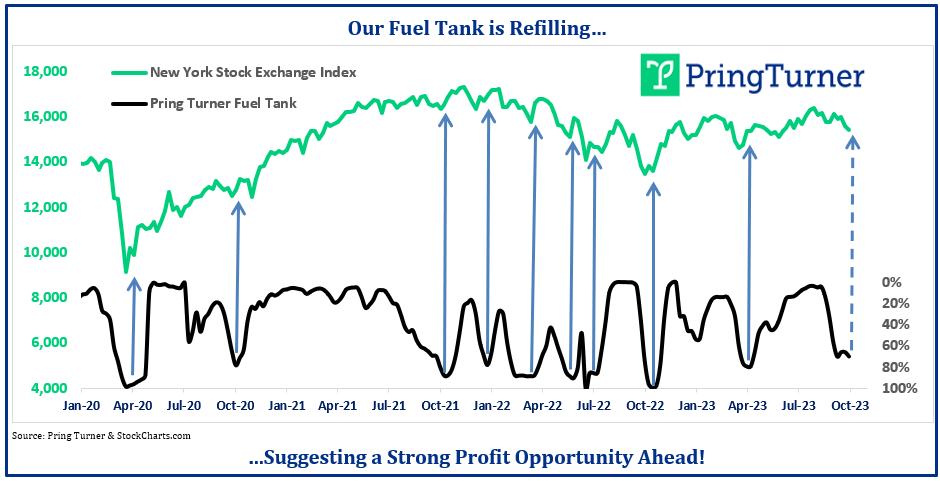

The Fuel Tank is Full!

The “Fuel Tank” is a nickname for our proprietary Intermediate Composite Model that helps us identify intermediate market turning points (2–6-month timeframe). This model, which ranges from 0% (empty) to 100% (full), is an invaluable risk management tool that measures whether the stock market tank is full (plenty of opportunity) or empty (more downside risk). The model is comprised of a number of indicators gauging swings in market trend and sentiment measures. A look at the latest full Fuel Tank reading shows why we have taken steps to get your portfolio more fully invested. The current positive reading shows there is plenty of fuel to take this market higher in the months ahead. Tactically, it makes sense to take advantage of any near-term market weakness to selectively increase your stock holdings.

Keep in mind, the Fuel Tank is just one of many tools that we use to measure risk versus opportunity in the stock market. Usually, this model will swing between full and empty a few times each year, allowing for timely opportunities to either prune or plant within your investment portfolio. Gradual portfolio shifts around these turning points are especially valuable as we strive to generate higher profits while taking less risk for you.

Summary

With the Pring Turner AIB model still in growth mode, this summers’ stock market swoon presents a timely opportunity to add quality investment themes to your portfolio. The “pause that refreshes” is refilling our fuel tank, adding another good reason to stay optimistic. These reliable stock market models are signaling more upside potential ahead and perhaps a strong finish to this year.

Thank you for the opportunity to help you achieve your financial goals with peace of mind! We appreciate that our wonderful clients, like you, have the patience, perseverance, and trust to stick with our conservative investment strategy through the inevitable ups and downs of investing. We value your confidence and will continue to work hard to earn your trust each day.

As always, please feel free to contact us should your circumstances change or if you have any questions.