The first quarter of 2022 proved to be a real challenge for investors. A mid-quarter 13% stock market plunge was particularly rough. Bonds were no help at all, as interest rates moved higher and prices declined sharply. Our January newsletter warned that “your investment portfolio will likely be subject to surprises, shocks, and unwelcome crises during the next twelve months and beyond”. Little did we know that the shock and crises would arrive so soon, inflamed by Russia’s grievous invasion of Ukraine. However, despite the crisis environment and, at one point, one of the worst quarters for stocks and bonds combined ever, we are pleased to report that you weathered the storm well.

Recession Ahead?

Several other factors contributed to the steep mid-quarter slide and rising of investor fears: sharply higher inflation, spiking oil prices, a less accommodative Federal Reserve policy, the potential for food shortages and, most importantly, fear that the U.S. economy is heading for recession. So, is this nascent business cycle expansion already over? No! We believe recession calls are premature and covered some of the reasons why in our February Client Event (click here for a recap of the event) Our research indicates no recession is imminent, only a throttling back of the growth rate.

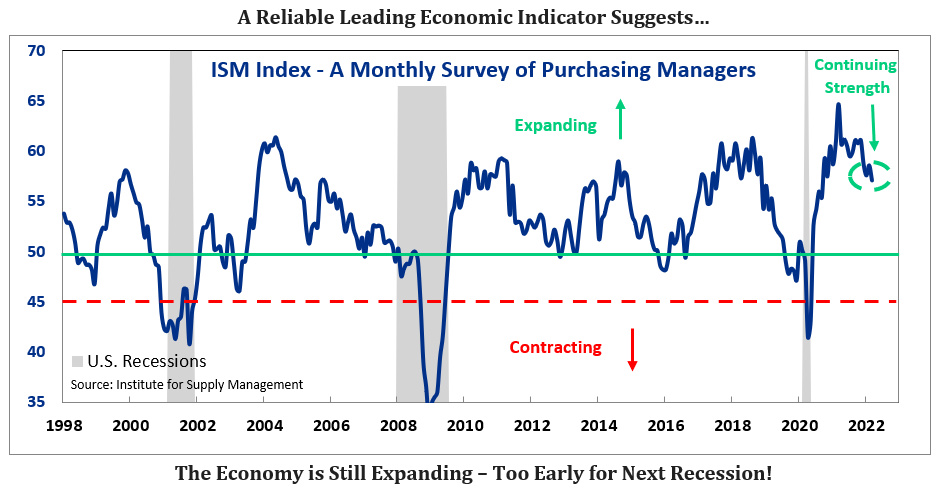

Case in point, one forecasting tool that anticipates changes in business conditions is the Institute of Supply Management Index (ISM Index) pictured at the top of page 2. The ISM survey is a monthly poll of members involved in corporate purchasing activities. The ISM Index is considered one of the most reliable leading economic indicators available and is a valuable tool to monitor the level and direction of manufacturing activity. A reading higher than 50% indicates the economy is expanding. In contrast, a sustained reading in the low-40’s warns of impending recession. The latest reading of 57.1 is down a few points from its peak, but clearly signals the economy will keep expanding, albeit at a slower pace.

Recession Caller

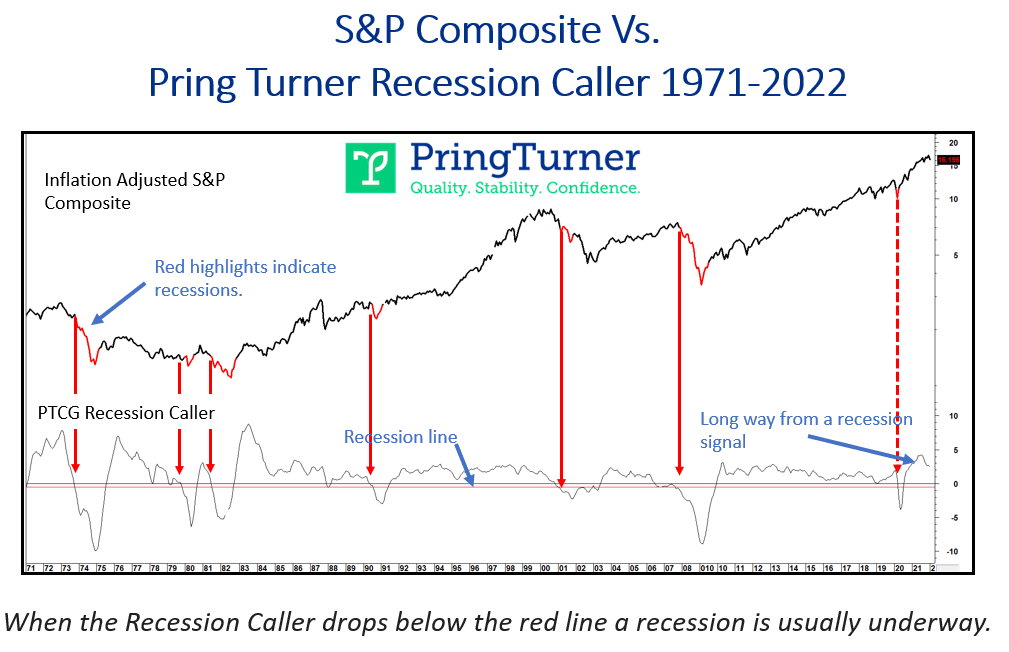

Our proprietary leading economic indicator, the Recession Caller, which we recently featured in our February client webinar, confirms this encouraging ISM outlook. This forecasting tool consists of several economic indicators including housing, retail sales, employment trends, and the S&P 500. The Recession Caller enables us to better gauge economic pressures and determine the likelihood that we are headed for a recession. Based on its current trajectory, this dependable indicator is still a long way from signaling a recession and reinforces the positive reading from the ISM Index.

Financial Market Opportunities

Historically, it takes a recession to bring on a major stock market decline of 25% or more. Given our view that there is no recession in sight for the duration of 2022, this clears the runway for the stock market to keep advancing. Certainly, the stock market will have temporary declines as they have recently experienced, but that is normal. One major concern is that inflation is heating up and reaching its highest levels since the 1970’s. Historically there have been specific investment sectors that tend to do well with a rising inflation environment such as energy, materials, real estate trusts and precious metals. These investment themes are well represented in your high-quality portfolio, enhancing the potential for higher returns as the business cycle progresses. Given the latest readings for the economy, like the featured ISM Index, and Recession Caller, our best advice remains: continue to stay positive!

With the Federal Reserve on a mission to curb inflation by raising interest rates, savers have at least one reason to cheer. For savers that have been squeezed out of decent interest returns, rising interest rates is welcome news. Perhaps it is not a giant step forward on cash yields, but you can earn a little more income today on your savings and portfolio cash reserves. For instance, two-year U.S. Treasury note yields have already spiked higher from a paltry .15% yield a year ago to over 2.3% recently. Our tactic for the fixed income side of your portfolio is to gradually take advantage of rising rates and further build out your bond ladder. By design, your bond investments have laddered maturity dates, providing a safe way to capture additional income returns while protecting your principal as interest rates climb.

Conclusion

An unusually volatile quarter for both stocks and bonds made for a bumpy and uncomfortable ride for many investors—but not for you! Your high-quality portfolio that emphasizes value and income performed relatively well throughout the volatility. Indeed, we found ways to take advantage of the market’s decline by selectively adding new investments for you.

Rest assured, we are always looking ahead for evidence of market turning points that would cause us to shift emphasis from wealth building tactics towards a more defensive position for your portfolio. It is our judgement that the myriad of current issues will still not derail the U.S. economy or stock market. So, in the meantime, we hope that you continue to stay positive in this wealth-building phase of the business cycle.

Thank you for your trust and the opportunity to serve you. As always, please feel free to contact us should you have any questions or if your financial circumstances should change.

Did you like this article?

Photo by Marcus Woodbridge on Unsplash