It is hard to imagine that only one year ago investors braced themselves for Armageddon as the Covid pandemic and related lockdowns suddenly gripped the world. Stock prices, reflecting intense investor anxieties, took a steep nosedive. Now, twelve months later, with the rapid rollout of Covid vaccines and our economy on a reopening path, investor confidence is steadily improving. Indeed, the major stock indexes have once again reached new all-time highs. Truly, what a difference a year makes!

Our April 2020 newsletter highlighted the importance for investors to remain focused on the long-term, despite momentary intense fears. It was our belief that the panicky conditions would eventually diminish and stock prices would recover. Our thoughts were:

“When the current storm passes, and it will, you are well positioned to quickly regain lost ground in the next bull market.”

Congratulations! Your patience and discipline with sticking to your investment plan was rewarded! So, then, after one of the most tumultuous economic years in history, what lies ahead for investors?

The major trend for stock prices is up and we expect continued upside progress as the rest of the year unfolds. Our primary trend tool, the Stock Speedometer (last featured in the October 2020 newsletter), remains firmly in the “safety zone” and confirms the favorable long-term backdrop. Progress with economic reopening will go a long way to bringing jobs back, boosting family income, and encouraging consumer spending. The massive government stimulus efforts over the last year, including checks to households and wide-ranging monetary actions by the Federal Reserve, will continue to work their way through the economy. The result is a re-accelerating business cycle expansion, higher corporate profits and cheerful investors!

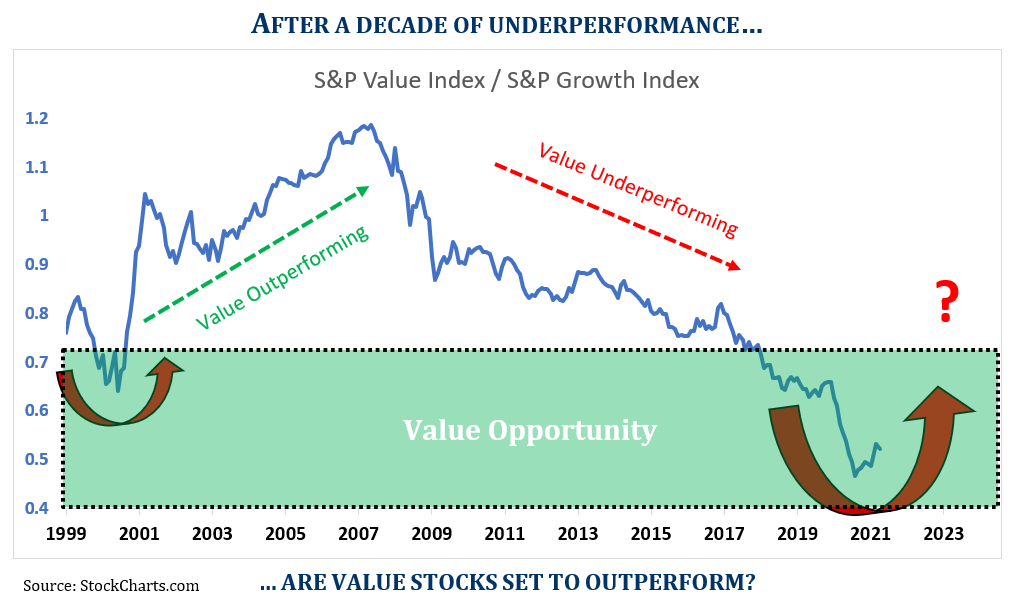

One major theme that is continuing to play out is the early signs of changing market leadership—from Growth to Value stocks. Our January newsletter alluded to what we believe is a promising long-term theme.

“The developing market trend toward value is certainly welcomed by us conservative investors who strive to generate consistent returns with dependable income.”—January, 2021

The above chart compares the long-term relative performance of Value vs. Growth stocks and shows that an important multi-year change in leadership may be underway. After more than a decade of Growth stock outperformance, Value stocks are starting to take the lead. In fact, we are hopeful a “value investor renaissance” could act as a nice tailwind for your portfolio for quite some time.

The Full Range of Emotions – From Widespread Fear to Pockets of Speculation!

We have often said that successful investors need to turn their emotions upside down. For instance, periods of intense fear, such as last March, often offer long-term investors low-risk opportunities. On the other hand, when profits seem easy and emotions turn more toward greed, we start to worry. Currently, we are witnessing a few pockets of intense speculation in the markets. Examples of the greedy excesses are apparent in the mania-like behavior of certain high-flying technology stocks, cryptocurrencies, and even for instance in the wild price movements of a struggling retail chain, Gamestop!

Many, especially younger investors in search of easy profits, seem to have been swept up in the latest day-trading frenzy. Some have even turbocharged their efforts by using their government stimulus checks and borrowing in margin accounts to trade their way to quick riches. Speculating in wildly gyrating trading vehicles may be exciting for a while, but manias almost always result in disappointment and even financial ruin for some. Our concern is that the eventual unwinding of these speculative bets could rattle the entire market temporarily. You can bet we are on alert for any short-term market selloff and ready should this present new long-term investment opportunities for you.

One final note on the subject: these latest speculative excesses and day-trading shenanigans bring to mind the cautionary words of famed economist, investor, and Professor Benjamin Graham.

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” — Ben Graham.

In other words, be an investor, not a speculator! Ben is often considered the “father of value investing” and has inspired many investors, including ourselves. His seminal book Security Analysis, co-authored with David Dodd in 1934, is considered one of the most influential financial books ever written. His words of wisdom still ring true after all these years.

“Ben Graham is the smartest man I ever knew.” – Warren Buffett

Summary

Rest assured, your portfolio is grounded in multiple layers of active risk protection. We are constantly on the lookout for high-quality securities that display strong financial muscle and are run by seasoned management teams. Each holding is chosen based on careful review of their long-term record of earnings consistency and ever-rising dividend income stream. Having many levels of disciplines gives us confidence that your investment portfolio can withstand any temporary market setbacks and is poised for growth. Unlike today’s day trading speculators, you are a long-term investor with a well-diversified portfolio of select businesses with the common characteristics of Quality, Value and Income. It is our fervent hope that, no matter the inevitable interim bouts of market weakness, this prudent and time-honored investment approach allows you to sleep better at night.

Thank you for your continued trust and placing with us the important responsibility of protecting and growing your wealth. As always, please feel free to contact us should you have any questions or if your financial situation changes.

Did you like this article?

Footnotes:

Photo by Pascale Amez on Unsplash